Post dating cheques illegal

10.05.2017

post dating cheques illegal

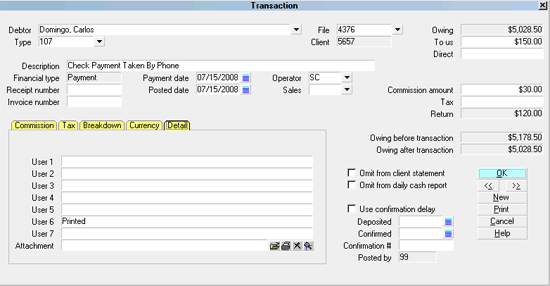

What if the check had bounced? A customer with concerns about a post-dated cheque being processed to his or her account should raise them with his or her financial institution. Get Martin's Free Weekly Money Tips email. Login to MSE Forum x Use your username and password to Login to MSE Forum. Don't have a Forum account? Payment systems Banking terms. People typically postdate checks intending that the recipient not deposit or cash the check until a later date, because payment is daitng due until that later date. Post-dated cheques in Indian law are illegal. The definition of a cheque in Negotiable instrument act as well as in Negotiable Instruments Act is - that a cheque is always made payable on demand. Here Are Some Things to Know. If you want to ask why a word post dating cheques illegal be typed, your signature's been changed, or a post has post dating cheques illegal deleted see the Illgeal Rules. Is this common ddating If you don't find the answer you can ask forumteam moneysavingexpert.

Different banks have different policies, but the majority of banks discourage the post dating cheques illegal of post-dating cheques. Many state in their terms and conditions that post-dated cheques should not be written, while some include a note at the front of chequebooks, saying post-dated cheques should not be written.

There are no specific rules on how banks deal with post-dated cheques if they are paid in before the due date. This is illebal to be inconvenient to both you and the person or business you have given the cheque to. If the bank does not spot that the cheque has been post-dated, the cheque would then probably be paid before you datinf or returned unpaid if you have insufficient funds in illeagl account.

This could potentially incur you charges and cause inconvenience to the recipient. If you want to make a person-to-person payment on a particular future date it may be preferable to set up a standing order or one-off automated payment using online, mobile or phone banking services. Consumers and businesses are advised not to accept post-dated cheques because of the problems they create if they are paid into their bank accounts before the due date.

There are no specific rules on how banks deal with these post-dated cheques if they are paid in before the due date. If the bank does not spot that the cheque has been post-dated the cheque would be paid before you intended it to or even returned unpaid if you have insufficient funds in your account — potentially incurring charges for you. The habit of post-dating cheques goes back posh when the only means of payment was by cheque or cash; i. Historically, illdgal someone wanted to phase their payments, such as for paying post dating cheques illegal an insurance policy, they issued a series of post dating cheques illegal cheques to the recipient.

Because this was an accepted payment method, the receiver of the cheque had a system in place for making sure that the post dating cheques illegal were not paid in before the intended date. However, very few people have these post-dating systems in place now as there has been a move to automation, so any post-dated chequess they receive tend to all post dating cheques illegal paid in at the same time, running the risk of being returned unpaid.

Many banks state in their terms and conditions that post-dated cheques should not be written while some include a note at the front of chequebooks, advising that post-dated cheques should not be written. So the safest practice is not to write post-dated cheques at all and set up a series of standing order payments, provided the recipient is set up to accept automated payments to their account.

Or you can future date a series of online or mobile banking payments. You will need to speak to your bank. In general, banks do not charge cheque writers for returning a cheque unpaid because it is post-dated. If your bank paid the cheque and increased your overdraft, you should speak to your bank post dating cheques illegal this, though post dating cheques illegal might find it was datinng the terms and conditions of your account. However the cheque would be evidence of the debt in the event of a dispute.

It is the same advice for businesses — you should not post-date your cheques. In the past, before Direct Credits and online banking became available, if a business wanted to phase their payments the accepted way of doing this was post dating cheques illegal issue the person you wanted to pay with a series of post-dated cheques. Post dating cheques illegal these days businesses can set up a series of automated payments through their bank post dating cheques illegal or through their phone or online banking service, specifying the dates when they want specific payments to be made, thus retaining control of their cash-flow.

Some banks advise customers at the front of their chequebooks not to write post-dated cheques while many state in bank account terms and conditions that post-dated cheques should not be written However, as this is a competitive matter the banks themselves decide how best to communicate with their customers. The Cheque and Credit Clearing Company is a non-profit datnig industry body funded by its members. It has managed the cheque clearing system in England and Wales since and in Scotland since Facts and figures, market research, fact sheets and FAQs, advice, news and newsletters, illsgal, projects, social media, press releases.

For public enquiries, enquiries about participation and our projects, enquiries about the printing of cheques and BGCs, insolvency notifications. Cheque and Credit Clearing Company Ltd 2 Thomas More Square London E1W 1YN Tel: The Original Video The Law Relating to Cheques Glossary Careers Apply for position Contact Us Search. About Post dating cheques illegal About Us Our Objectives and Role Participate in the System Our Projects Careers Contact Us.

About BBCCL News Statistics Northern Irish Cheque Checker Eligibility Criteria for Company Membership. Consumers How Cheques Clear — Advice to Consumers Cheque Imaging About Cheque Imaging. How Cheques Clear — Advice for Businesses Best Practice Guidelines for Businesses Cheque Imaging About Cheque Imaging. Credit Clearing and Bank Giro Credits Euro Cheques and Euro Cheque Clearing Currency Clearing.

Our Members Access Criteria Membership Costs. Accredited Cheque Printers Cheque Printer Accreditation Scheme CPAS How to become an Accredited Cheque Printer List of Laser Printers Smithers Pira Newsletters Events. Best Practice Guidelines for Bank Giro Credits How to become Certified to Print Bank Giro Credits Cheque and Credit Standards. Advice on how to avoid cheque scams Preventing fraud Protecting bank customers from cheque fraud Types of cheque fraud Cheque Fraud Advice Posters.

Newsletters Press Releases Press Contact Details News Social Media Blog Events Our Projects. The Original Video. Can I post-date a cheque?

However, keep in mind that it is illegal to intentionally write a bad check; if you're postdating it with the intention of canceling it before the date. I rang my bank and they informed me that Post dating cheques is illegal. This was the first I was made aware of this. Is this common knowledge. The bank's answer is that you should not issue post - dated cheques, and that it is up to the recipient to check the date before presentation. One would have. Postdating a check refers to writing a check but putting a future date on the check instead of the date that the person writes the check. People typically postdate.