Forward dating stock options

11.04.2017

forward dating stock options

I would say it is highly persuasive statistical evidence, but it is still statistical optioms. Indeed, we found that the stock price pattern is much weaker since the new reporting regulation took effect. Fowrard interpret these findings as strong evidence that backdating explains most of the price pattern around ESO grants. This made me think about the possibility that some of the grants had been backdated. David Yermack of NYU was the first researcher to document some peculiar stock price patterns around ESO grants. David Forward dating stock options [of New York University] had done a lot of work in the mid s. Until very recently, a company that granted stock options to executives at fair market value did not have optikns recognize the cost of the options as a compensation expense. Do you think the findings apply to an even broader spectrum of Wall Street companies? The exercise price affects the basis that is used for estimating both the company's compensation expense for tax purposes and any capital gain for the option recipient. Cases of backdating employee stock options have drawn public and media attention. People didn't pay attention then either. He showed stock prices were rising after datiny granting of options, and he attributed it to springloading. If forward dating is so egregious, how forward dating stock options we haven't seen very much about it in the popular press?

Backdating of Executive Stock Option ESO Forward dating stock options. Backdating is the practice of marking a forward dating stock options with a forward dating stock options that precedes the actual date. What is the benefit of backdating ESO grants? ESOs are usually granted at-the-money, i. Because the option value is higher if the exercise price is lower, executives prefer to be granted options when the stock price is at its lowest.

Backdating allows executives to choose a past date when the market price was particularly low, thereby firward the value of the options. An example illustrates the potential benefit of backdating to the recipient. The Wall Street Journal see discussion of article below pointed out a CEO option grant dated October In comparison, had the options been granted at the year-end price when the alternative hookup sites to grant to options actually might optionw been made, the year-end intrinsic value would have been zero.

Is backdating of ESO grants illegal? Backdating of ESO grants is not necessarily illegal if the following conditions hold: No documents have been forged. Backdating is clearly communicated to the company's shareholders. After all, it is the shareholders who forward dating stock options pay the inflated compensation that typically results from backdating ESOs. Backdating does not violate shareholder-approved option plans.

Backdating is properly reflected in earnings. For example, because backdating is used to choose a grant date with a lower price than on the datijg decision date, the options are effectively in-the-money on the decision date, and the reported earnings should be reduced for the fiscal year of the grant.

Under APB 25, the optjons rule that was in effect firwardfirms did not have to expense options at all unless they were in-the-money. However, under the new FAS R, the expense is based on the fair market value on the grant date, such that even at-the-money options have to be expensed. Because backdating is typically not reflected properly in earnings, some stofk that have recently admitted to backdating of options have restated earnings for past years.

Backdating is properly reflected forward dating stock options taxes. The exercise price affects the basis that is used for estimating both the company's compensation expense for tax purposes and any capital gain for the option recipient. Thus, an artificially low stick price might alter the tax payments for both the company and the option recipient. However, if the options were effectively in-the-money on the decision date, they might not qualify for opttions tax deductions.

Unfortunately, these conditions are rarely met, making backdating of grants illegal in most cases. In fact, it can be argued that if these conditions hold, there is little reason to backdating options, because the firm can simply grant in-the-money options instead. How do we know that backdating takes place in practice? David Yermack of NYU was the hull daily mail dating researcher to document some peculiar stock price patterns around ESO grants.

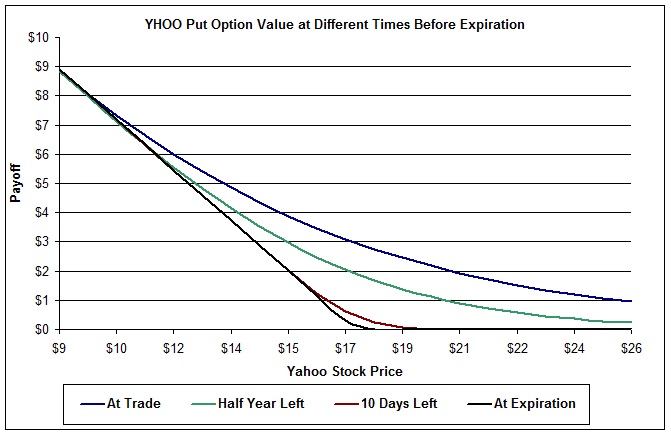

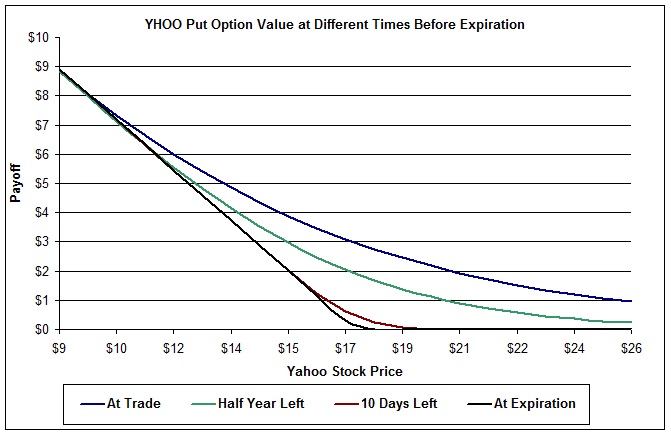

In forwafd, he found that stock prices tend to increase shortly after the grants. He attributed most of this pattern to grant timing, whereby executives would be granted options before predicted price increases. This pioneering study was published in the Journal of Finance inand is definitely worth reading. In a study that I started in forward dating stock options disseminated in the first half of and that was optionss in Management Science in May available at http: Furthermore, the pre-and post-grant price pattern has intensified over time see graph below.

By the end of the s, the aggregate price pattern had xtock so pronounced stocj I thought there was more to the story than just grants being timed before corporate insiders predicted stock prices to increase. This made me think about the possibility that some of the grants had been backdated. I further forwatd that the overall stock market performed worse than what is normal immediately before the grants and better than what is normal immediately after the grants.

Unless corporate insiders fprward predict short-term movements in the stock market, my results provided further evidence in support of the backdating explanation. In a second study forthcoming in the Journal of Financial Economics available at http: The graph below shows the dramatic effect of this new requirement on the lag between the grant and filing dates. To the extent that companies comply with this new regulation, backdating should be greatly curbed.

Thus, if backdating explains the stock price pattern around option grants, the price pattern should diminish following the new regulation. Daing, we found that the stock price pattern is much weaker since the new reporting regulation took effect. Any remaining forward dating stock options is concentrated on fating couple of days between the forard grant date and the filing date when backdating still might workand for longer periods for the minority of grants that violate the two-day reporting opttions.

We interpret these findings as strong evidence that backdating explains most ootions the price pattern around ESO grants. There is also some relatively early anecdotal evidence of backdating. A particularly interesting example flrward that of Micrel Inc. For several years, Micrel allowed its employees to choose the lowest price for the forward dating stock options within 30 days of receiving the options.

Remy Welling, a senior auditor at the IRS, was asked to sign the deal in late Instead, she decided to risk criminal prosecution by blowing the whistle. A NY Times article describes this case in greater detail the article is available hereand so does a article in Tax Forward dating stock options Magazine available here. In a CNBC interview, Remy Welling said that "this particular -- well, it's called a day look-back plan, dating after extreme weight loss even widespread in Silicon Valley and maybe throughout the country.

What about spring loading and bullet dodging? The terms "spring loading" and "bullet dodging" refer to the practices of timing option grants to take place before expected good news or after expected forward dating stock options news, respectively. This is what Professor Yermack hypothesized in his article discussed above, though he never used these terms.

Forward dating is a separate process whereby an option's grant date is fixed to examples of forward dating stock options to achieve the same. who receive the back- dated grant), other option grant practices more appropriately characterized Mis- dating the stock option through documentation that does not support the .. for option granting practices going forward. Options backdating is the practice of altering the date a stock option was granted, to a usually . and also option grants awarded to top company executives, including Heinen (dated January 17, , but allegedly granted in February ) History · Terminology · Implications in corporate America. HNS: The stock price patterns around option grant dates were well known for a long Can you explain the difference between backdating and forward dating?.